Portfolio management

Many business challenges involve selecting a portfolio of projects or investments. Examples include selecting investments, research and development projects, or tools to mitigate financial, operational, or cyber risks. Here are a range of case studies and examples applying Analytica to optimize and manage portfolios.

Navigating the heat pump landscape

Fort Collins, Lumina, and Apex Analytics have created a tool to help reduce greenhouse gas emissions by optimizing building electrification programs.

How utilities are reducing risks & saving money

Learn about the Risk Spend Efficiency (RSE) framework, how California utilities have been using it, and RSE within ANAGRAM (Analytica for Natural Gas Risk Analysis and Management).

Green accountability & incentives

Join Robert Brown's webinar as he reflects on the social and economic cost of CO2 in new capital projects using Analytica.

Quantifying methane emissions

Aerial surveys found that a small number of high-impact super-emitting events are responsible for most methane emissions, which were significantly higher than previously estimated.

Exploring the future of the automobile

Can alternative technologies such as biofuels, natural gas, electric vehicles, or hydrogen fuel cells reduce greenhouse gas emissions and dependency on oil?

Auto maker saves $250M on warranty costs

A major US auto maker used Analytica to identify drivers to skyrocketing costs to service warranties, resulting in major savings.

Evaluating R&D at W.L.Gore

W.L. Gore & Associates, developer of GORE-TEX® fabrics, use Analytica to assess the technical and market risks and revenues of their portfolio of R&D projects.

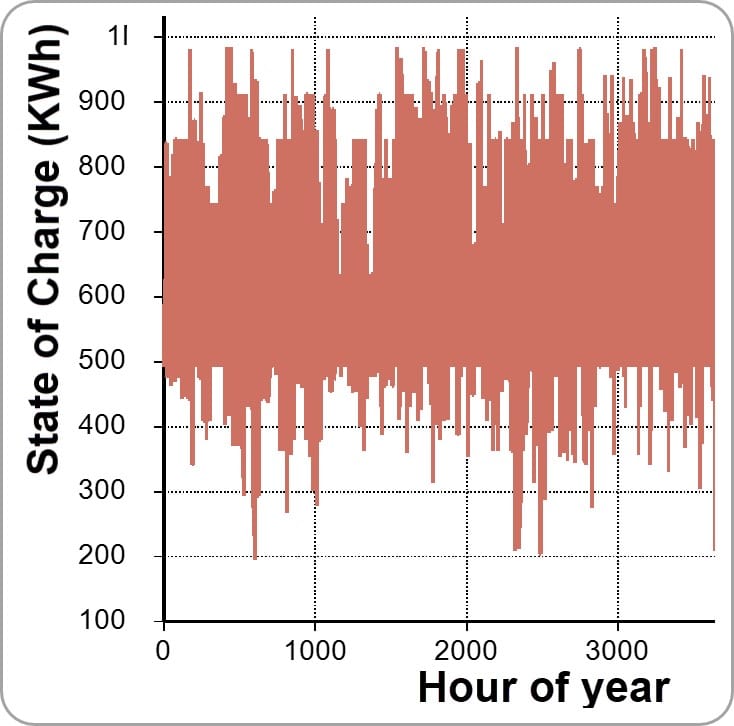

Electrical energy storage valuation tool

Analytica was used to build an energy storage modeling application to evaluate the costs and benefits of various storage technologies.