Risk & uncertainty

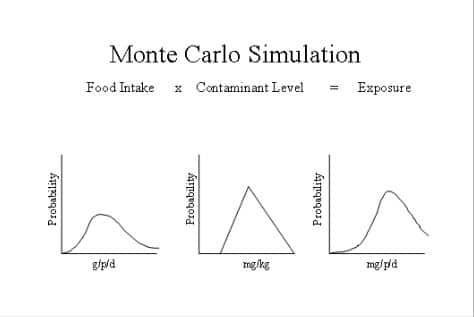

From its inception, Analytica was designed to analyze risk and uncertainty — unlike spreadsheet applications which require special add-ins. Analytica’s fully integrated features for sensitivity analysis, scenario analysis and Monte Carlo simulation make it remarkably simple to treat risk and uncertainty in your models. Here are some examples of how organizations are using these methods.

Embrace risk & uncertainty

Risk and uncertainty are inevitable. Discover how best to mitigate risks and find robust decisions so that your clients can prosper under a wide range of possible futures.

Latin hypercube vs. Monte Carlo sampling

In a post on LinkedIn, David Vose argues that the advantages of Latin Hypercube sampling (LHS) over Monte Carlo are so minimal that “LHS does not deserve a place in modern...

The value of knowing how little you know

Understand the Expected Value of Including Uncertainty (EVIU), compare with the Expected Value of Perfect Information (EVPI), and the insights it gives into a variety of problems.

How utilities are reducing risks & saving money

Learn about the Risk Spend Efficiency (RSE) framework, how California utilities have been using it, and RSE within ANAGRAM (Analytica for Natural Gas Risk Analysis and Management).

Monte Carlo simulation tips & tricks

Get expert advice and practical guidance in using Monte Carlo simulation to improve modeling accuracy and efficiency.

Could humans lose control over advanced AI?

Researchers used Analytica's influence diagrams to map out arguments and scenarios exploring risks with artificial intelligence (AI).

Helping gas utilities reduce risk with RSE

Learn about the decision-support web application named ANAGRAM (Analytica for Natural Gas Risk Analysis and Management).

The value of knowing what you don’t know

Grasp how acknowledging uncertainties in models can boost decision-making and enhance model accuracy in this blog.

Some Analytica customers