Risk & uncertainty

From its inception, Analytica was designed to analyze risk and uncertainty — unlike spreadsheet applications which require special add-ins. Analytica’s fully integrated features for sensitivity analysis, scenario analysis and Monte Carlo simulation make it remarkably simple to treat risk and uncertainty in your models. Here are some examples of how organizations are using these methods.

Enterprise risk management & handling concentration risk

Concentration risk is a term that is used frequently in financial institutions to describe a risk that is significantly greater than others; for example, lending a high amount of ...

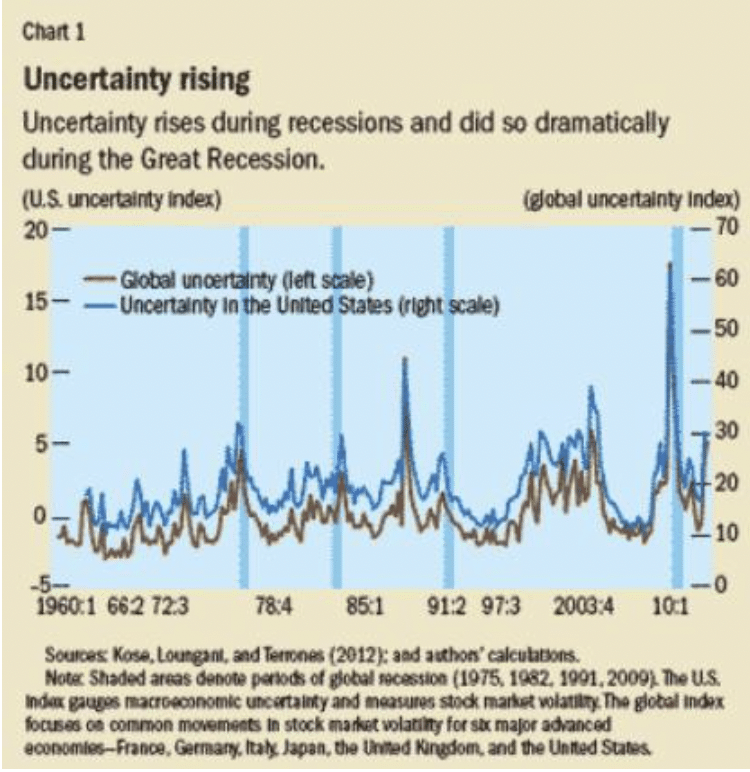

Measuring uncertainty in economics: chicken or egg?

Conventional wisdom has long held that uncertainty is a cause of weakening in an economy. The theory goes that uncertainty first causes people and companies wait and see before ...

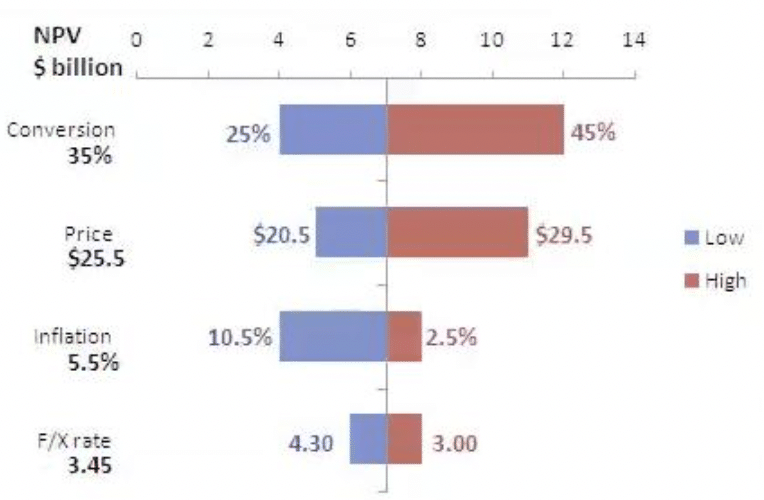

Sensitivity analysis: one at a time or all together?

The whole is greater than the sum of the parts, say Aristotle and Gestalt psychology. The whole effect of combined factors of a model in terms of sensitivity may also be greater ...

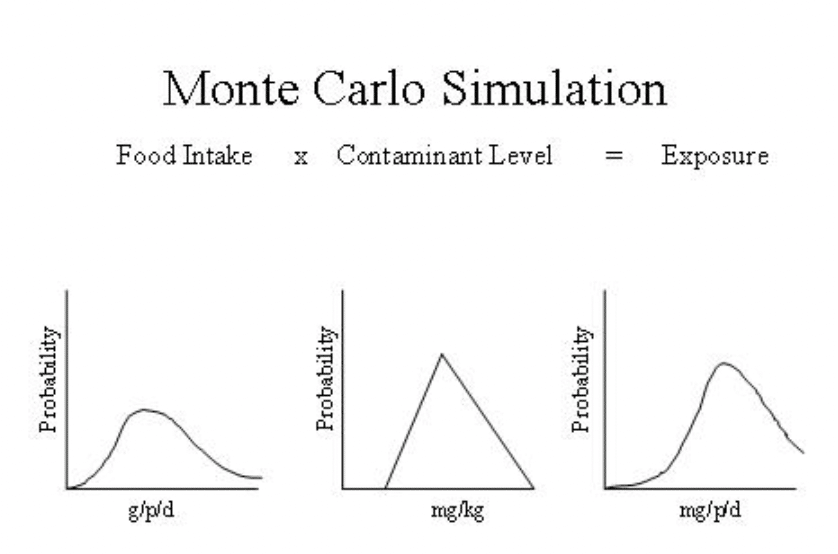

Uncertainty analysis & Monte Carlo methods

Uncertainty analysis is often a prominent part of studies for sectors such as the environment. The uncertainty itself is determined by a number of elements.

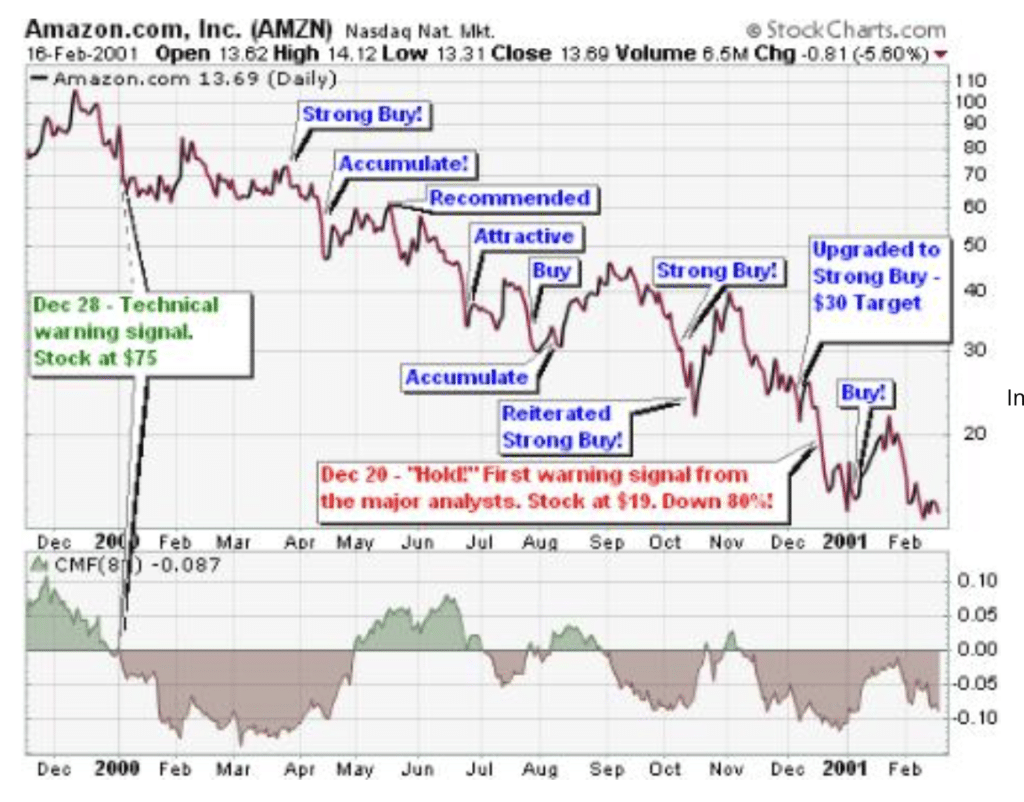

Can back-testing improve your strategic risk management?

Back testing is a favorite with those who want to test out a plan for the future with real data. The real data for the future are not (of course) yet available, however the data ...

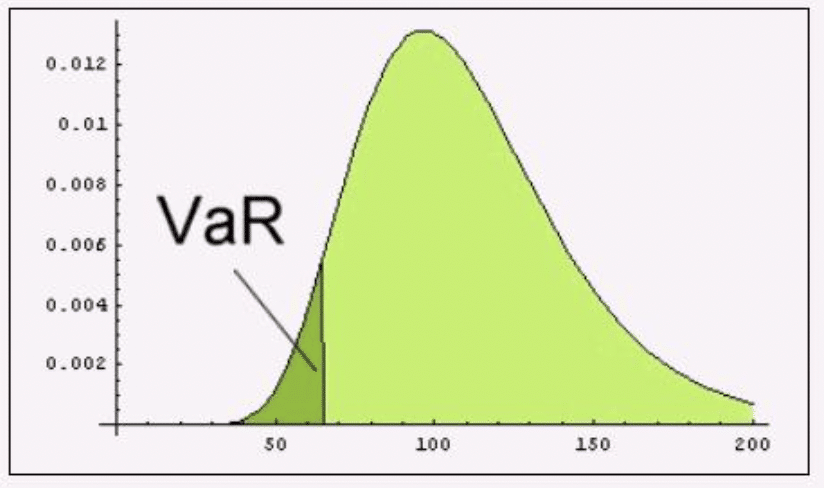

Risk management & VaR: not safe for everybody?

Value at Risk (VaR) rose to fame in answer to a number of financial disasters, including the 1998 failure of Long Term Capital Management. Much of the criticism at the time was ...

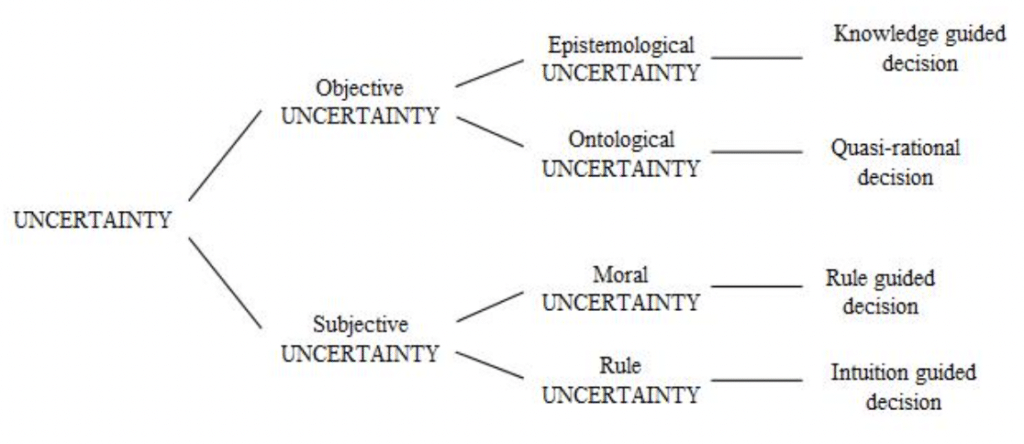

Measuring uncertainty & understanding propagation

I used to be uncertain, but now I’m not so sure. Whatever the cause, uncertainty is a fundamental part of the real world and has to be dealt with. By way of a definition, ...

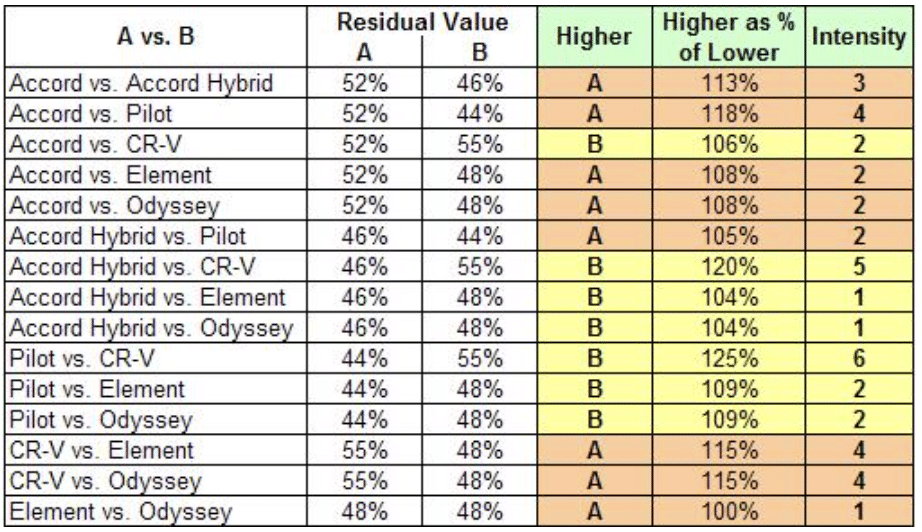

When multi-attribute decision analysis needs Monte Carlo

Multi-attribute decision analysis (MADA) is by definition a complex matter. Trying to balance or optimize a number of criteria at the same time in order to make a decision is ...

Some Analytica customers