Risk & uncertainty

From its inception, Analytica was designed to analyze risk and uncertainty — unlike spreadsheet applications which require special add-ins. Analytica’s fully integrated features for sensitivity analysis, scenario analysis and Monte Carlo simulation make it remarkably simple to treat risk and uncertainty in your models. Here are some examples of how organizations are using these methods.

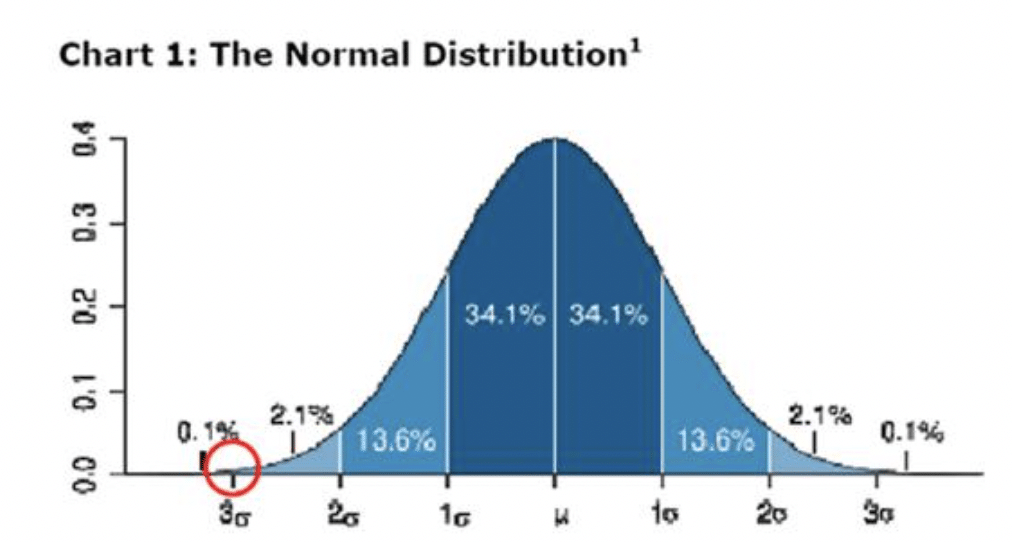

Standard deviation for normal people

Standard deviation (SD) is a mathematical way of indicating what is normal or what is exceptional. Some people get very creative with the concept. Applications include anything ...

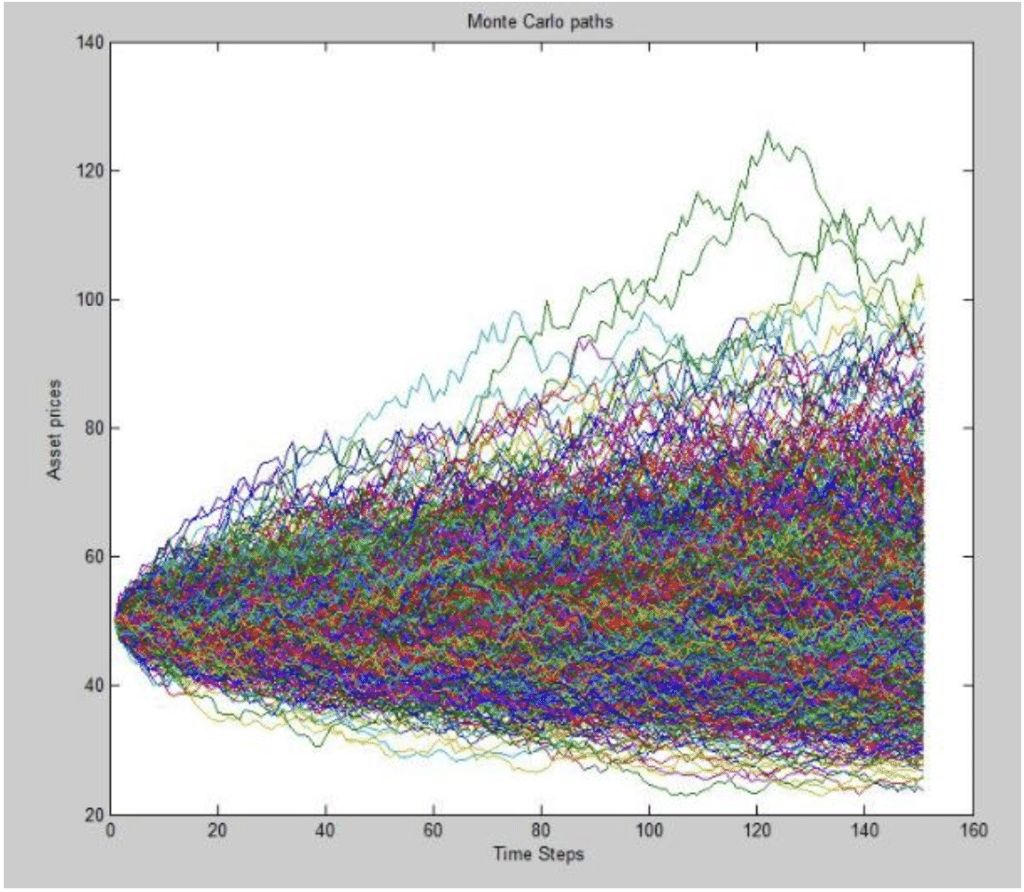

Monte Carlo modeling in personal finance: the ‘whoops’ factor

‘Don’t take a personal investment or retirement financing decision before we’ve done Monte Carlo modeling for you!’ When you think that Monte Carlo methods started as a way to ...

Risk assessment in business continuity

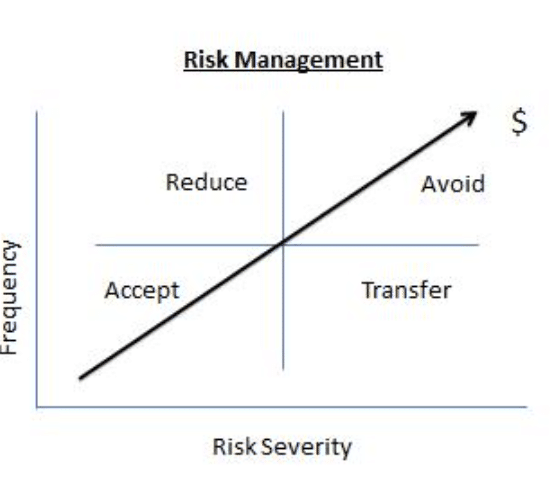

Risk assessment is often cited as a key part of business continuity planning: the discipline of ensuring an organization can keep on working in the face of adversity.

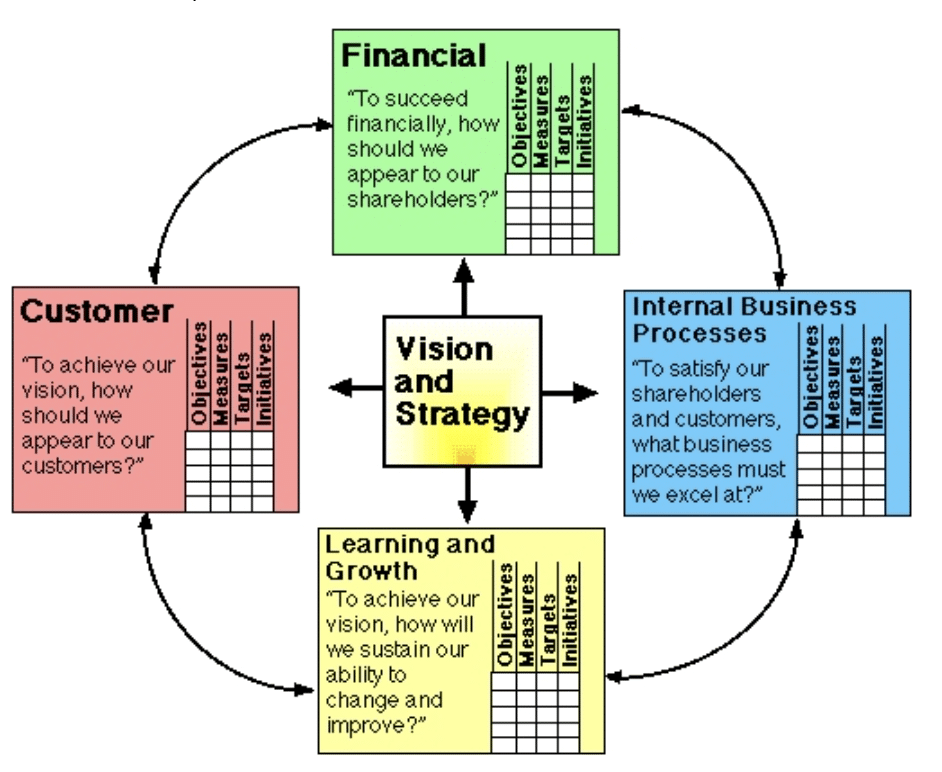

Balanced scorecard, meet decision analytics!

If you’ve used the balanced scorecard approach before, you’ll know that it extends the older concept of purely financial measures of a company’s performance.

Risk analysis using FRAP: is it just silo thinking?

FRAP or the Facilitated Risk Analysis Process aims to get conclusions about risks quicker. It involves a group of subject matter experts and a facilitator, which gives it ...

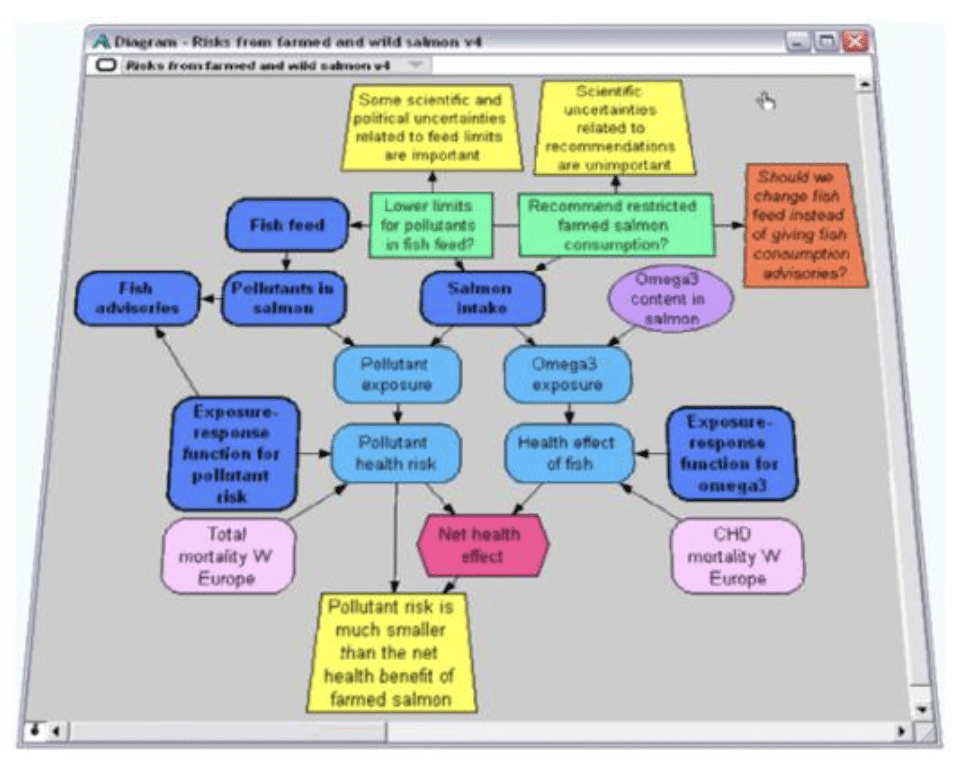

Risk management: fish, finance & tradeoffs

Eating fish is good for you, isn’t it? Yes. And No. While fish are valuable nutritionally, especially the ones rich in omega-3 fatty acids, they may also contain methylmercury.

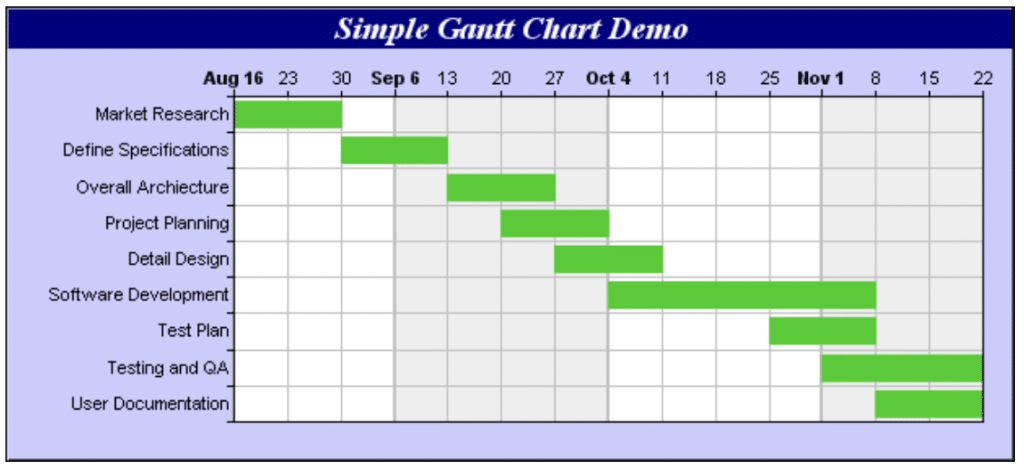

When will it be ready? Monte Carlo analysis for schedules

You may be able to throw more money and people at a project, even if it’s not always advisable. But time? When time’s gone, it’s gone. To help plan and track project schedules, ...

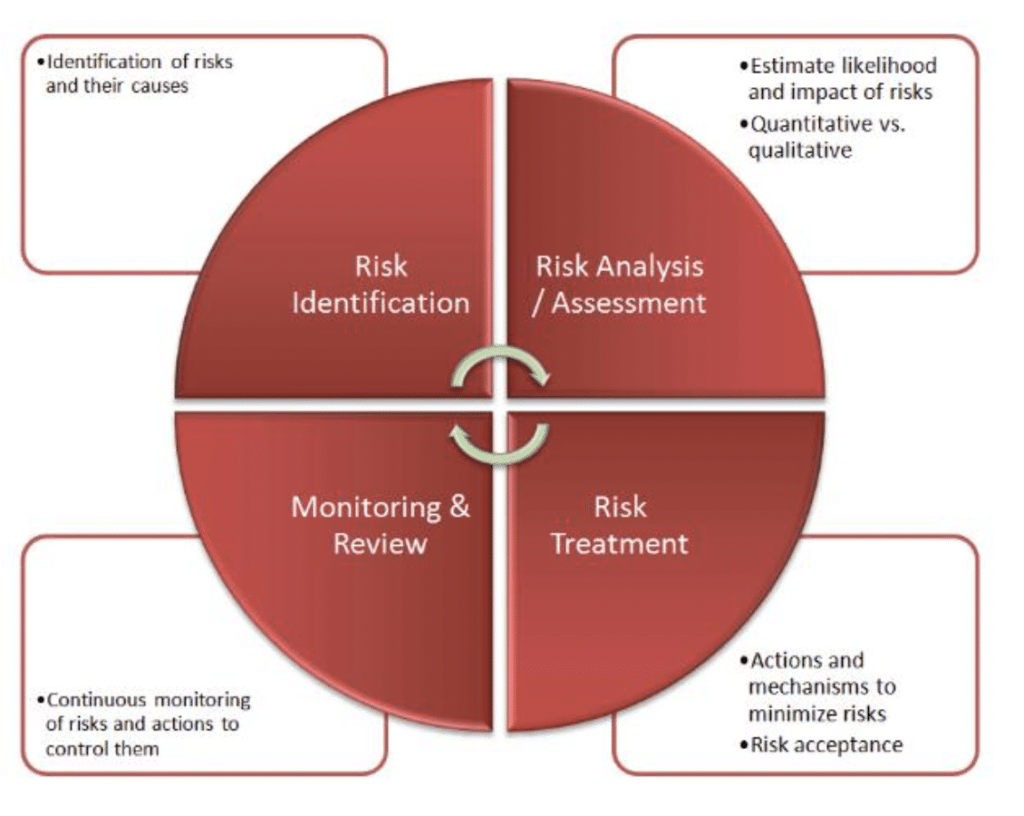

Risk analysis in project management

The first challenge in understanding risk analysis in project management is to nail the definition of risk analysis. International standards like ISO 31000 notwithstanding, ...

Some Analytica customers